Table Of Content

- Faster, easier mortgage lending

- Home Loan Rates Increased Over the Last Week: Today’s Mortgage Rates for April 23, 2024

- Compare 30-Year Mortgage Rates for April 2024

- Year Jumbo Fixed

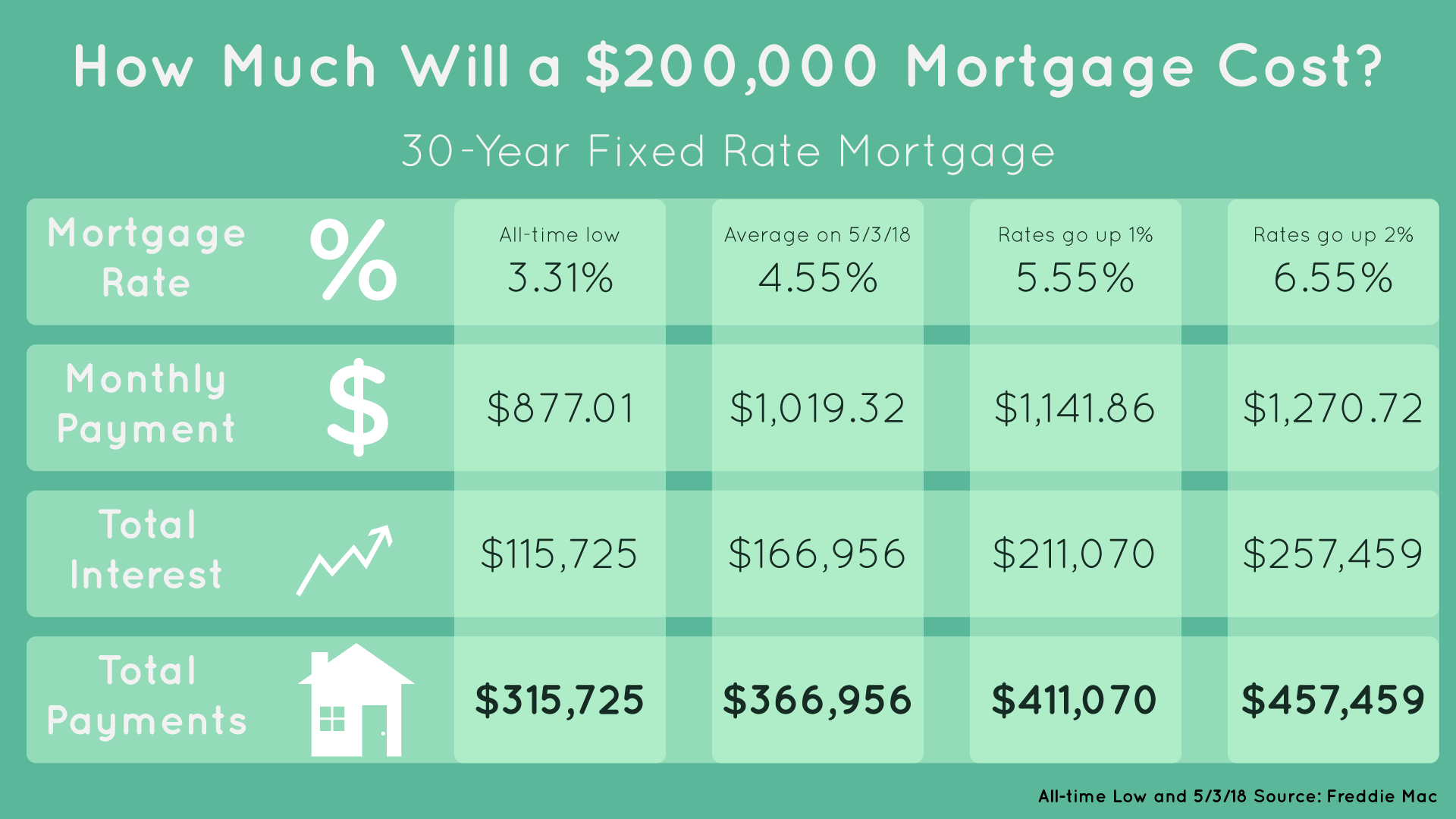

- How Today’s Mortgage Rates Affect Your Monthly Payments

- What’s the difference between APR and interest rate?

- How to lower your monthly mortgage payment

Chris Jennings is a writer and editor with more than seven years of experience in the personal finance and mortgage space. He enjoys simplifying complex mortgage topics for first-time homebuyers and homeowners alike. His work has been featured in a number of outlets, including Yahoo Finance, MSN, Fox Business, and GOBankingRates. Most rate locks last 30 to 60 days and your lender may not charge a fee for this initial period. However, extending the rate lock period up to 90 or 120 days is possible, depending on your lender, but additional costs may apply. If you come from a qualifying military background, VA loans can be your best option.

Faster, easier mortgage lending

We're unlikely to see significant rate drops until autumn at the earliest. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Explore mortgage options to fit your purchasing scenario and save money. The average rate for a 15-year, fixed mortgage is 6.76%, which is an increase of 12 basis points from seven days ago.

Home Loan Rates Increased Over the Last Week: Today’s Mortgage Rates for April 23, 2024

Along with the recent surge in mortgage rates, home prices remain near record levels. When rates fall, that’ll spur demand, too, so you might want to get ahead of any potential rush into the market. For homeowners looking to leverage their home's value to cover a big purchase — such as a home renovation — a home equity line of credit (HELOC) may be a good option while we wait for mortgage rates to ease. Check out some of our best HELOC lenders to start your search for the right loan for you. Treasury yields climbed even higher, with the 10-year rate topping 4.6%, sending other borrowing costs up too.

Compare 30-Year Mortgage Rates for April 2024

Some lenders offer first-time home buyer loans and grants with relaxed down payment requirements as low as 3%. The Federal Reserve’s rate decisions and inflation can influence rates to move higher or lower. Although the Fed raising rates doesn’t directly cause mortgage rates to rise, an increase to its benchmark interest rate makes it more expensive for banks to lend money to consumers.

Average long-term US mortgage rate climbs above 7% to highest level since late November - The Associated Press

Average long-term US mortgage rate climbs above 7% to highest level since late November.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

Buying a house in California is a pricey proposition, but first-time homebuyers might qualify for grants or other forms of help. The Federal Reserve has shown signs that it’s unlikely to raise rates again soon, and investors and market watchers are waiting expectantly for the first cut of 2024. However, a cut likely won’t materialize until summer, at the earliest. After selecting your top options, connect with lenders online or on the phone. Then choose a lender, finalize your details, and lock in your rate.

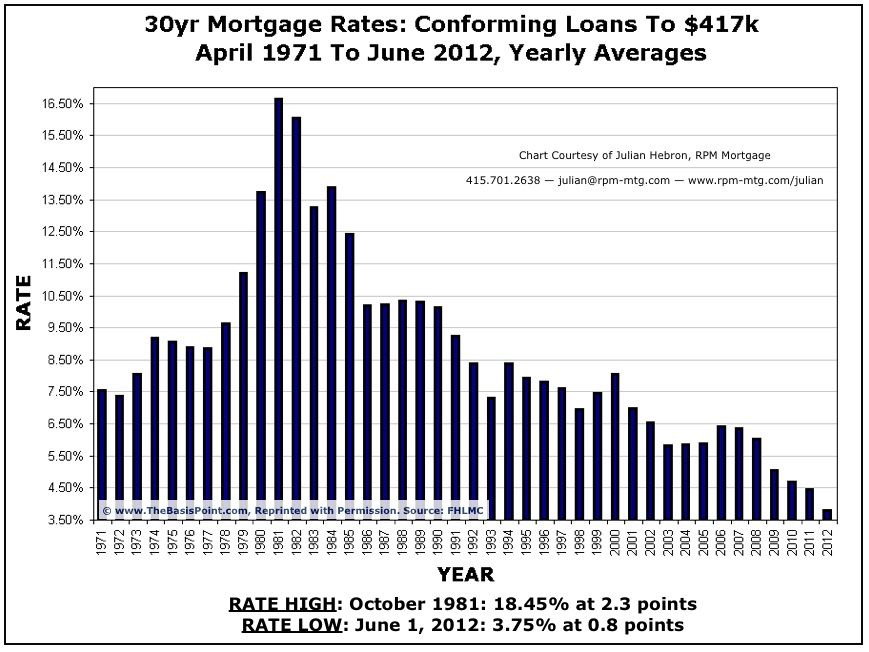

The 30-year fixed rate mortgage surged past 7% for the first time this year, according to Freddie Mac’s reading on Thursday. In April 2021, mortgage rates were at about 3 percent, less than half the current rate. They began to climb that year and continued to rise in 2022 when the Federal Reserve started raising its benchmark rate in an effort to combat inflation. Although inflation has since cooled significantly, it’s still above the central bank’s 2 percent target.

Mortgage Rates Today: April 25, 2024—Rates Remain Fairly Steady - Forbes

Mortgage Rates Today: April 25, 2024—Rates Remain Fairly Steady.

Posted: Thu, 25 Apr 2024 10:00:22 GMT [source]

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. If you secure a fixed mortgage rate your payments won't be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the [Refinance] radio button. Adjustable-rate mortgage (ARM) loans are listed as an option in the [Loan Type] check boxes.

What’s the difference between APR and interest rate?

The Ascent, a Motley Fool service, does not cover all offers on the market. Kimberly is a career writer and editor with more than 30 years' experience. She's a bankruptcy survivor, small business owner, and homeschool parent. In addition to writing for The Motley Fool, she offers content strategy to financial technology startups, owns and manages a 350-writer content agency, and offers pro-bono financial counseling. These are the eight factors that can help you get the best current mortgage rate.

How to lower your monthly mortgage payment

The highest mortgage rate on record was 18.63% in October 1981, which makes a 7.17% rate not seem so bad. It’s also very unlikely that rates will drop to below 3% again anytime soon. This is five basis points higher than last week and up 73 points since a year ago. That may influence which products we write about, but it does not affect what we write about them. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing.

Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria. In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point. Programs, rates, terms and conditions are subject to change without notice. Individuals should begin their mortgage search before they begin their home search.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. The compensation we receive may impact how products and links appear on our site. Here’s a look at where some major housing authorities expect average mortgage rates to land. Mortgage forecasters base their projections on different data, but most housing market experts predict rates will move toward 6% by the end of 2024.

Bankrate is an independent, advertising-supported publisher and comparison service. We arecompensatedin exchange for placement of sponsored products and services, or when you click on certain links posted on our site. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to stricteditorial guidelines. “With the economy expected to soften in 2024, the Federal Reserve Bank will begin loosening its monetary policy next year.

No comments:

Post a Comment